Nothing seems to strike more fear in the hearts of San Francisco residents, especially affluent workers in the tech industry or those who own a business, corporation, or other income-producing asset than the AMT (Alternative Minimum Tax). The AMT represents a kind of “parallel tax code” in which the IRS seems to play a kind of “gotcha.” If you have “too many deductions” vs. “too much income,” your tax is calculated in both the “traditional” and “AMT” tax system, and (guess what), you owe whichever tax is greater. The new tax law makes some significant modifications to the AMT.

Here’s a summary. But remember – no two individuals or businesses or the same, so if you think you may be owing AMT, please reach out to us for a tax consultation. We have a convenient San Francisco office and can also meet over the phone or via WebX. The way to think about the AMT is to pre-think about it as you structure your income streams; with some clever planning, we can minimize your AMT exposure under the current (2017) or future (2018 – forward) law.

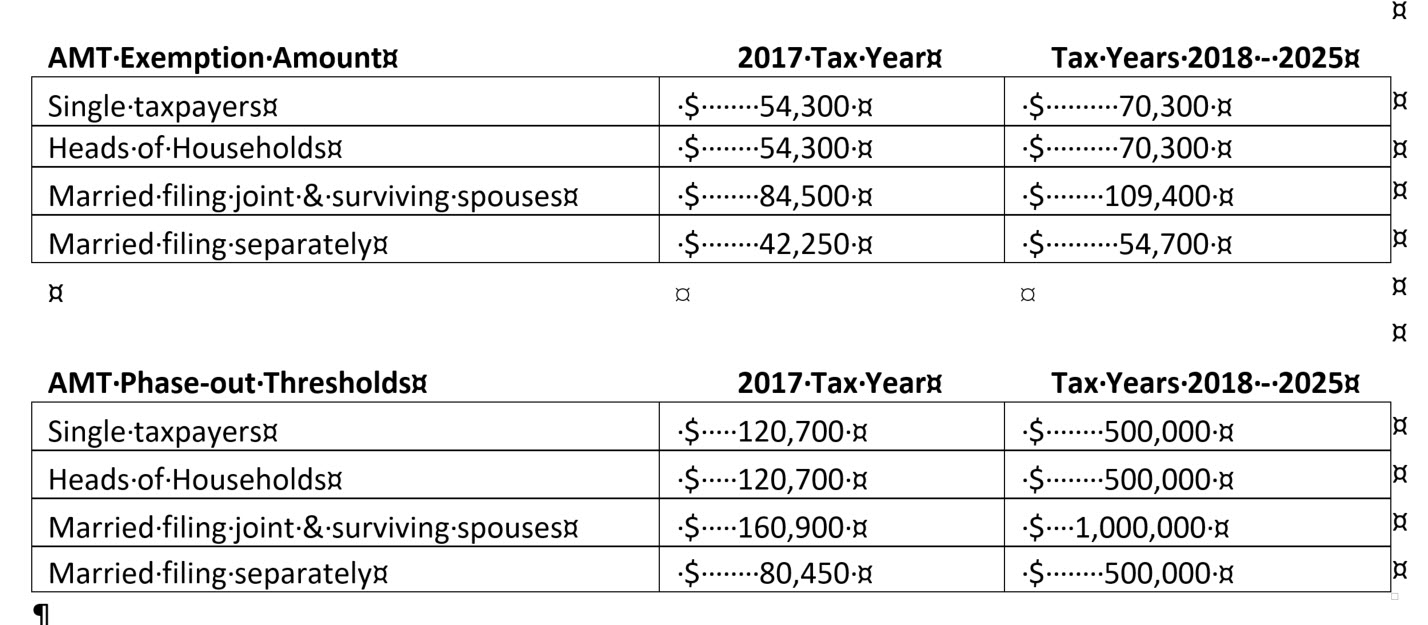

While alternative minimum tax (“AMT”) has been repealed for corporations, individuals remain subject to AMT under the new Act but with increased exemptions and phase-out thresholds. The changes to the exemptions and thresholds are as follows:

Got Questions?

The AMT is complicated. So remember if you think you may be facing it, reach out to us for a tax consultation. As the #1 San Francisco Tax Preparation service for high income individuals and corporations, we can do an in-depth analysis of your taxes.