Editor’s Note. The new tax law makes big changes in how businesses are taxed, and which forms of business organization are the most advantageous. Many of our San Francisco clients are not only high income but also often have diverse business interests, including overseas interests that expose them to international tax issues. Others, especially those who work in San Francisco’s vibrant technology sector, have business interests in start ups (we’re known as the best CPA firm for startups in San Francisco), or perhaps have stock options as part of their compensation. Still others have small or medium-sized businesses and want to know how to optimize their businesses here in the San Francisco Bay Area to minimize the tax bit. This post is a discussion, but if you need a consultation, reach out to one of our San Francisco-based tax CPAs.

After unifying the House and Senate tax reform provisions into one piece of legislation, the Tax Cuts and Jobs Act, H.R. 1 (“the Act”) was approved in the House and Senate and signed by President Trump on December 22, 2017. The bill represents the most significant revision of the US tax code in decades and will have many long-term effects.

An overview of some of the significant provisions affecting business taxpayers are identified below.

Details of Business Provisions

New Income Tax Rates and Brackets

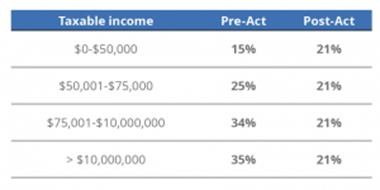

Under pre-Act law, corporations were subject to graduated tax rates of 15% to 35% as taxable income increased. Personal service corporations were subject to a flat 35% tax rate on their entire taxable income. For tax years beginning after December 31, 2017, the corporate tax rate is a flat 21% tax rate. A summary of the pre- and post-Act rates for corporations is as follows:

Repeal of Alternative Minimum Tax

While alternative minimum tax (“AMT”) was left in place for individuals, the corporate AMT of 20% has been repealed for tax years beginning after December 31, 2017. The full amount of the minimum tax credit (“MTC”) will be allowed in tax years before 2022 as the AMT credit can offset regular tax liability in an amount equal to 50% (100% for tax years beginning in 2021) of the excess of the MTC for the tax year over the amount of the credit allowable for the year against regular tax liability.

Depreciation and Expensing

Increased 179 Expensing

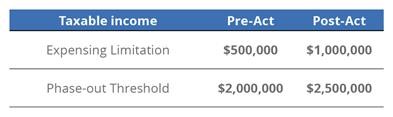

Under Code Section 179, taxpayers may elect to deduct the cost of qualifying property. For taxable years beginning after December 31, 2017, the Act increases both the maximum amount a taxpayer can expense and the phase-out threshold as follows:

The Act also expands the definition of ‘qualified real property’ to include certain depreciable tangible personal property used predominately to furnish lodging or in connection with furnishing lodging and improvements to nonresidential real property (roofs, heating, ventilation, and air-conditioning property, fire protection and alarm systems, and security systems).

Bonus Depreciation

Under pre-Act law, businesses could immediately deduct 50% of the cost of eligible property (of which original use began with the taxpayer) in the year the property was placed in service before 2020 (2021 for certain property with a longer production period). The Act extends and modifies bonus depreciation by allowing businesses to deduct 100% of the cost of eligible property acquired and placed in service after September 27, 2017 and before January 1, 2023 (before January 1, 2024 for certain property with longer production periods). For property placed in service in later years, the bonus depreciation phases down as follows:

- 80% for property placed in service in 2023

- 60% for property placed in service in 2024

- 40% for property placed in service in 2025

- 20% for property placed in service in 2026

The Act removes the ‘original use’ condition that only new property qualifies for bonus depreciation. Furthermore, the Act expands the definition of eligible property to include qualified film, television and live theatrical productions for productions placed in service after September 27, 2017. A production is considered placed in service at the time of initial release, broadcast, or live staged performance.

In lieu of claiming 100% bonus depreciation for tax years ending after September 27, 2017, taxpayers can elect to claim 50% bonus depreciation.

The Act repeals the election to accelerate AMT credits in lieu of bonus depreciation.

Luxury Automobile Depreciation Limits

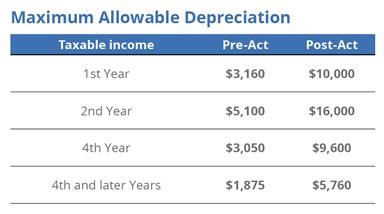

The Act limits Section 179 expensing and depreciation for certain passenger automobiles, otherwise known as the ‘luxury automobile depreciation limits.’ For passenger automobiles placed in service for which additional bonus depreciation is not claimed, the maximum allowable depreciation deduction is limited per year. Under the Act, the allowable depreciation deductions are increased as follows:

These dollar amounts are indexed for inflation for passenger automobiles placed in service after 2018. The maximum first-year depreciation allowance for passenger automobiles eligible for additional first year bonus depreciation remains at $8,000, whereas under pre-Act law, the amount would phase down from $8,000 by $1,600 per calendar year beginning in 2018.

Shortened Recovery Period for Real Property

Under pre-Act law, most real property was subject to a 39 year and 27.5-year recovery period for nonresidential and residential rental property, respectively. The separate definition of qualified leasehold improvement property, qualified restaurant property, and qualified retail improvement property is eliminated and replaced with a single definition for ‘qualified improvement property’ for property placed in service after December 31, 2017. Furthermore, a 15 year recovery period (20 year ADS) and straight-line depreciation are provided for such qualified improvement property. Also, the ADS recovery period for residential rental property is shortened from 40 years to 30 years as a result of the Act.

Net Operating Loss Deduction Reformed

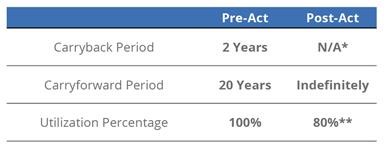

The Act modifies the net operating loss (“NOL”) deduction by eliminating the carryback period, making the carryforward period permanent, and reducing the amount utilizable in a given year as follows:

*A 2-year carryback applies in the case of certain losses incurred in the trade or business of farming.

**NOLs of property and casualty insurance companies can be carried back two years and carried over for 20 years to offset 100% of taxable income in those years.

Business Interest Deduction Limitation

Subject to a number of limitations (known as the ‘thin capitalization rules’), the Act generally allows businesses to deduct interest paid or accrued. Under pre-Act law, interest expense was disallowed by a corporation in a tax year if the payor’s net interest expense exceeded 50% of its adjusted taxable income, which was determined without regard to net interest expense, net operating losses, domestic production activities, depreciation, amortization, and depletion. With the passage of the Act, for tax years beginning after December 31, 2017, every business, regardless of its entity type, is generally subject to a deduction disallowance for net interest expense in excess of 30% of the business’ adjusted taxable income. For tax years beginning after December 31, 2017 and before January 1, 2022, adjusted taxable income is computed without regard to deductions allowable for domestic production activities (repealed – see below), depreciation, amortization, or depletion. After 2021, the adjusted taxable income takes into account depreciation, amortization, and depletion. Any disallowed interest is carried forward indefinitely.

Pass-through entities are required to determine the net interest expense disallowance at the entity (e.g. partnership) level, not the partner level.

Businesses with average annual gross receipts for the three-tax year period ending with the prior taxable year that do not exceed $25 million are exempt from these rules.

Domestic Production Activities Deduction Repealed

Taxpayers with qualified production activities income from property that was manufactured, produced, grown, or extracted within the US; qualified film productions; construction activities, and certain other activities, were allowed to claim a domestic production activities deduction (“DPAD”) under pre-Act law. The DPAD was equal to 9% of the lesser of the taxpayer’s qualified production activities income or the taxpayer’s taxable income for the tax year. The DPAD is repealed for non-corporate and C-corporations for tax years beginning after December 31, 2017 and December 31, 2018, respectively.

Changes in Taxpayer Accounting Methods

Use of the following new provisions are considered a change in the taxpayer’s accounting method.

Research and Experimental Expenditure Recovery Period – Under pre-Act law, with election, certain research and experimentation (“R&E”) expenditures were treated by taxpayers as deductible in the current year, capitalized and recovered ratably over useful life of the research (but not over a period less than 60 months), or capitalized and recovered over a period of 10 years. Under the new law, amounts paid or incurred for specified R&E expenses (including software development) in tax years beginning after December 31, 2021 must be capitalized and amortized ratably over a 5-year period. The period is extended to 15 years if the R&E expenditures are conducted outside of the U.S.

Advanced Payments – The Act codifies Rev. Proc. 2004-34 to allow taxpayers to defer the inclusion of income associated with certain advanced payments to the end of the tax year following the tax year of receipt if such income is deferred for financial statement purposes.

Expanded Test for Cash Method of Accounting – Under pre-Act law, C corporations and partnerships with a C corporation partner were required to use the accrual method of accounting, unless these businesses had average annual gross receipts of not more than $5 million over the prior three years. Under the new law, the three-year average gross receipts threshold is increased from $5 million to $25 million.

Inventory Accounting and Capitalization – Under the Act, businesses that meet the $25 million average annual gross receipts test are:

- exempt from UNICAP provisions, which require all direct costs and an allocable portion of most indirect costs associated with production or resale activities to be capitalized, and

- exempt from inventory reporting, and instead allow taxpayers to use a method of accounting that either treats inventories as non-incidental materials and supplies or conforms to the taxpayer’s financial accounting.

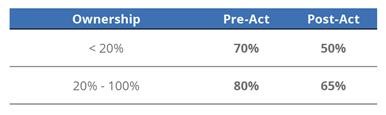

Dividends Received Deduction Percentages Reduced

Corporations can deduct a percentage of certain dividends received during its tax year. The Act reduces the dividends received deduction (“DRD”) percentages as follows for taxable years beginning after December 31, 2017:

Excessive Employee Compensation Limitation for Covered Employees

Publicly traded corporations may deduct no more than $1 million per year for compensation paid or accrued with respect to a covered employee. Under pre-Act law, covered employees included the principal executive officer and their three most highly compensated officers. The new law expands the definition to include the principal financial officer as well. Under the Act, the $1 million exception for commissions, performance-based remuneration (including stock options), prepayments to a tax-qualified retirement plan, and amounts excludable from the covered employee’s gross income are repealed. Furthermore, if an individual is a covered employee with respect to a corporation for a tax year beginning after December 31, 2016, the individual remains a covered employee indefinitely.

Other Provisions

- Orphan Drug Credit Reduced – The Orphan Drug Credit is limited to 25% (reduced from 50% previously) of qualified clinical testing expenses under the new law.

- Qualified Opportunity Zones – The Act provides temporary deferral of capital gains that are invested in a Qualified Opportunity Zone (“QOZ”) and a permanent exclusion of capital gains from the sale or exchange of an investment in the QOZ that are held for at least 10 years.

- Credit for Employer-Paid Family and Medical Leave – Businesses may claim a general business credit of 12.5% of the amount of wages paid to qualifying employees during any period where the employees are on family and medical leave if the rate of payment is 50% of the wages normally paid to the employee for tax years beginning after December 31, 2017 and before January 1, 2020.

- Meals and Entertainment Deductions Limited – Under the new law, the ability to deduct 50% of entertainment is repealed and the current 50% limit on the deductibility of business meals is extended to include meals provided through an in-house cafeteria or otherwise on the premises of the employer. Previously, meals in-house provided for the convenience of the employer on the business premises of the employer were fully deductible. For tax years after December 31, 2025, the new law will completely disallow an employer’s deduction for meals provided for the convenience of the employer on the employer’s business premises.

- Repeal of Employer Deduction for Certain Fringe Benefits – The new law repeals the employer deduction for employee transportation (parking and mass transit), but the exclusion from income for such benefits received by an employee is retained.

Safe Harbor LLP Insights

The Act is the largest overhaul of the tax system in over three decades impacting both individuals and businesses. Unlike the individual provision, which are generally temporary and sunset after 2025, many of the business provisions are permanent. Therefore, we recommend reviewing your business tax situation with Safe Harbor’s experienced tax professionals and consultants – we are here to help you navigate the changes of this comprehensive tax reform.

Editor’s Note. As you can see, the law’s changes of the tax code are complex with respect to businesses of every type, including corporations. If you own a business or have business interests in San Francisco, the greater Bay Area, or elsewhere in California, reach out to us for a free consultation on our business tax preparation services. We often act as an Outsourced CFO for many small or medium-sized businesses, and we can help you as the #1 business tax CPA in San Francisco. Your first step is that call.