Editor’s Note. The so-called “Trump Tax Law” is provoking confusion and anxiety throughout the San Francisco Bay Area. Politics aside, we’re talking about the provisions of the new tax law. Among them are reductions in the deductibility of local and state taxes (a big issue in high tax California) as well as big changes to deductions and the relationship between individual income and business income. If you are looking for a tax CPA here in San Francisco, one who work with high net worth individuals and those with complex tax issues, please reach out for a consultations on individual tax preparation. We’re known as one of the best tax CPAs in San Francisco, California.

After unifying the House and Senate tax reform provisions into one piece of legislation, the Tax Cuts and Jobs Act, H.R. 1 (“the Act”) was approved in the House and Senate and signed by President Trump on December 22, 2017. The Act represents the most significant revision of the US tax code in decades and will have many long-term effects.

An overview of some of the significant provisions affecting individual taxpayers are identified below.

Additional tax alerts for Business | International

Details of Individual Provisions

New Income Tax Rates and Brackets

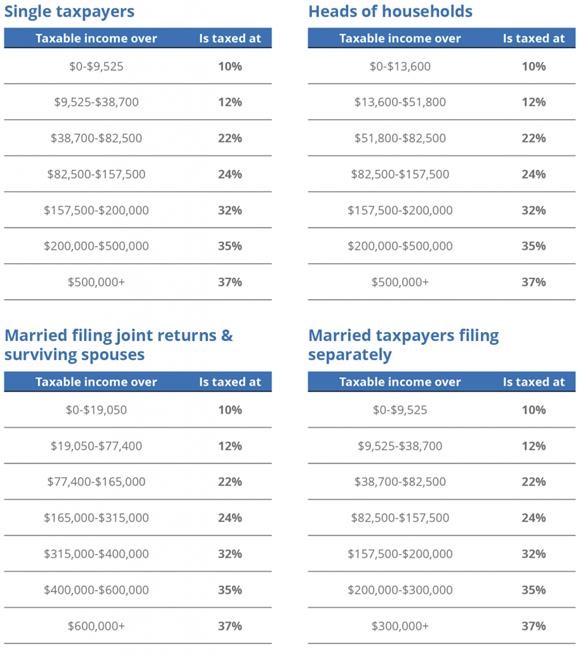

The Act provides four tax rate schedules, each of which is divided into income ranges that are taxed at progressively higher marginal tax rates as income increases. Under pre-Act law, individuals were subject to the following tax rates: 10%, 15%, 25%, 28%, 33%, 35%, and 39.6%. For tax years beginning after December 31, 2017 and before January 1, 2026, the following tax brackets apply for individuals:

The Act also provides four brackets for estates and trusts as follows:

Increased Standard Deduction

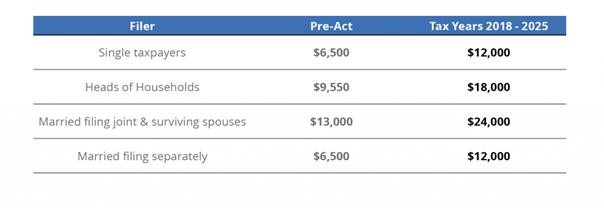

Taxpayers who do not itemize their deductions are allowed to reduce their adjusted gross income (“AGI”) by the standard deduction to determine their taxable income. The amounts under pre- and post-Act are as follows:

Suspension of Personal Exemptions

Under new law, for tax years beginning after December 31, 2017 and before January 1, 2026, the ability to subtract personal exemption deductions from AGI has been suspended. Lower income earners were previously allowed to deduct $4,150 for each personal exemption, generally for the taxpayer, the taxpayer’s spouse, and any dependent.

Decreased Limit to Itemized Deductions

- Home mortgage interest – Under pre-Act law, the home mortgage interest deduction is limited to acquisition indebtedness of $1 million. The limitation will be reduced to $750,000 under the new law. However, taxpayers who entered into a binding written contract by December 15, 2017 to close on the purchase of a principal residence before January 1, 2018, and who purchase that residence before April 1, 2018, will be considered to have incurred acquisition indebtedness prior to December 15, 2017, and will be allowed to use the current $1 million limitation

- Home equity interest – Under pre-Act law, taxpayers were able to deduct interest on qualifying home equity indebtedness up to $100,000 for regular tax purposes. For tax years through 2025, the home equity loan interest deduction has been repealed.

- State and local taxes – Under the new law, the deduction for state and local income or property taxes is limited to $10,000 for taxpayers ($5,000 for married taxpayers filing separately). Under the Act, taxpayers cannot take a deduction for 2017 for prepaid 2018 state taxes as these are considered deposits, which are not tax deductible.

- Charitable contributions – The Act increases the income-based percentage limit for charitable contributions of cash to public charities from 50% to 60%.

- Miscellaneous itemized deductions – Certain miscellaneous deductions (unreimbursed employee expenses, tax preparation fees, and other expenses including investment fees and expenses) previously subject to the 2% AGI floor are repealed through 2025 under the new Act.

- Medical Expenses – The Act reduces the threshold for deduction of medical expenses from 10% to 7.5% of AGI for the 2017 and 2018 tax years.

Deduction for Pass-through Income

Under pre-Act law, income from pass-through businesses (sole proprietorships, partnerships, and S corporations) was reported on the individual tax returns of the owners or shareholders, and therefore subject to individual income tax rates. Under the new law, for tax years beginning after December 31, 2017 and before January 1, 2026, a non-corporate taxpayer (including trusts and/or estates), would be allowed to deduct 20% of “qualified business income” from a sole proprietorship, partnership, or S corporation, as well as 20% of qualified real estate investment trust (“REIT”) dividends, qualified cooperative dividends, and qualified publicly traded partnership income.

The deduction is disallowed for specified service trades or businesses with taxable income above a threshold (taxable income in excess of $157,500 for all taxpayers other than married filing joint returns, which is $315,000). Furthermore, a limitation on the deduction is phased in based on W-2 wages above a taxable income threshold.

“Qualified business income” means the net amount of qualified items of income, gain, deduction, and loss with respect to the qualified trade or business of the taxpayer. These items must be effectively connected with the conduct of a trade or business within the United States. Qualified business income does not include specified investment-related income, deductions, or losses.

“Qualified business income” does not include an S corporation shareholder’s reasonable compensation, guaranteed payments, or payments to a partner who is acting in a capacity other than his or her capacity as a partner.

“Specified service trades or businesses” include any trade or business in the fields of accounting, health, law, consulting, athletics, financial services, brokerage services, or any business where the principal asset of the business is the reputation or skill of one or more of its employees.

The taxpayer is allowed to deduct 20% of the qualified business income for each qualified trade or business. The deduction is generally limited to 50% of the W-2 wages paid with respect to the business, however capital-intensive businesses may produce a higher deduction under a rule that takes into consideration 25% of wages paid plus a portion of the business’s basis in its tangible assets. But if the taxpayer’s income is below the threshold amount, the deductible amount for each qualified trade or business is equal to 20% of the qualified business income with respect to each respective trade or business.

Other Provisions

- Alimony – For divorce or separation agreements executed after December 31, 2018, the Act treats alimony and separate maintenance payments as not deductible by the payor spouse or includible as income by the payee spouse.

- Moving expenses and reimbursement – Except for members of the armed forces on active duty who move pursuant to a military order and incident to a permanent change of station, moving expense deductions would be repealed through 2025 under the new Act. The new Act also excludes gross income and wages from qualified moving expense reimbursements.

- IRA recharacterization – Taxpayers are prevented from unwinding Roth conversions using recharacterization under the new Act, which excludes conversion contributions to Roth IRAs.

- Individual mandate – Taxpayers who do not obtain insurance that provides at least minimum essential coverage will not be subjected to a penalty for tax years after 2018.

- Modification to kiddie tax – Under the new Act, the taxable income of a child attributable to earned and unearned income is taxed under the rates for single individuals and trusts & estates, respectively. Under pre-Act law, net unearned income (less some exemptions) of a child was taxed at the parents’ rates if the parents’ tax rates were higher than the tax rates of the child.

- Child tax credit – The child tax credit increases from $1,000 to $2,000 per qualifying child (maximum refundable amount of the credit is $1,400) and a new nonrefundable $500 credit for qualifying dependents who are not children is provided under the Act. The credit begins to phase-out at $400,000 for married filling joint taxpayers (increased from $110,000) and $200,000 for all other taxpayers (increased from $55,000 for married filing separate and $75,000 for all other taxpayers).

- Education provisions – Section 529 plans may not distribute more than $10,000 in expenses for tuition incurred during the tax year at an elementary or secondary school. The Act also modifies the exclusion of student loan discharges from gross income.

Doubled Exemption for Estate and Gift Tax

The exemption for estate and gift tax for estates of decedents dying and gifts made after December 31, 2017 and before January 1, 2026 doubles from $5 million to $10 million (indexed for inflation occurring after 2011).

Increased Alternative Minimum Tax Exemption and Phase-out Thresholds

While alternative minimum tax (“AMT”) has been repealed for corporations, individuals remain subject to AMT under the new Act but with increased exemptions and phase-out thresholds. The changes to the exemptions and thresholds are as follows:

Safe Harbor LLP Insights

The Tax Cuts and Jobs Act will be the largest overhaul of the tax system in over three decades and will have a significant impact on both individuals and businesses. Unlike the business provisions, which are generally permanent, many of the individual tax provisions in the Act are temporary and sunset after 2025. Therefore, we recommend reviewing your personal tax situation with Safe Harbor’s experienced tax professionals and consultants – we are here to help you navigate the changes of the comprehensive tax reform.

Editor’s Summary. This post has overviewed some of the tax changes that impact individuals under the new tax law. If you live or work in San Francisco, in the San Francisco Bay Area, or elsewhere in California, and are looking for a CPA firm that prepares individual taxes and has expertise in complex tax issues, reach out to one of our San Francisco-based accountants for a consultation!